Phuket’s Tourism High-Season Hopes Shattered in Policy Flip-flop

- Press Releases

- |

New airport and hotel data from research group C9 Hotelworks triggers alarm bells over worsening economic outlook

For Immediate Release, 10th November, 2020

Phuket: Thailand’s leading resort island Phuket has come face-to-face with the reality that it’s tourism high-season will not see a marked reopening to overseas travelers. In the wake of the dismantling of the ‘Phuket Model’ and refocus by the government on using Bangkok as a single international gateway, there is increasing alarm over the lack of a path forward for the island’s rice bowl – tourism.

The key tourism indicator for the island is airlift and Phuket International Airport is the gateway for 70-80% of visitors to the destination. According to Airports of Thailand data, 121,530 passengers arrived in the month of September. This equates to just over 4,000 arrivals a day and a portion of these include local residents and business people. Comparing year-on-year data, 2019’s daily arrivals which included international travelers was five times higher.

Commenting on the toxic situation, hospitality consulting group C9 Hotelworks Managing Director Bill Barnett says “there is a dramatic change in the market mix where the current domestic-led average length of stay for hotels is approximately 1.8 days, while for foreign travelers it’s more than double this amount. What this means for hotels is severely reduced overall demand across the island’s entire accommodation sector.”

Looking forward to the high season when the numbers spike upwards in the four months of December through March, the high season months last year equated to more than one-third of annual demand. Total domestic and international arrivals at the airport totaled just over 9 million in 2019. Adding in high season shoulder months into the equation, the stark economic impact of Phuket’s economic seasonality is reflected in the fact that well over half of the island’s tourism arrivals are packed into a six-month period.

Now, nearly two months into that timeframe, what is apparent is it’s virtually impossible to save the high season and hotel owners in 2021 will be forced to contend with historically the lowest trading months of the year by May. Given these grim prospects, C9 is predicting large-scale job losses and business closures given there is no light at the end of the pandemic-induced tunnel.

“Taking a 360-degree view on the restricted domestic-only demand, you have to take into account that Phuket’s current registered accommodation supply has continued to surge to its present size of 90,267 rooms in 1,773 hotels/tourism establishments” adds Barnett. “Of this supply upper midscale, upscale, and luxury properties of international standards are approximately 25% of the total rooms.”

Data from leading data intelligence provider STR daily has Phuket occupancy averaging 10% with upward spikes on weekends at international standard hotels. Looking into the number though, the reality is domestic travelers are cashing in on cheap deals at upscale and luxury hotels. Given limited visitor arrivals the far larger mid and economy tiers where most of the hotel inventory sits, are experiencing even lower occupancy. This domino effect is expected to prevail unabated throughout a sustained downturn and effectively crushes the smaller properties and local tourism businesses.

As Thailand’s government policy has maintained Bangkok as the sole entry point for a limited number of travelers from overseas under the Alternative State Quarantine (ASQ) program, a number of hotels in all tiers are operating under the scheme. Hotel performance data for Bangkok from STR is reflecting occupancy just above 25% for international standard hotels, though again in the broader marketplace demand is at considerably lower levels.

In Phuket, many hotels pinned high-season hope on the now-aborted ‘Phuket Model’ to allow Special Tourist Visa’s (STV’s) aimed at long-staying visitors, which is logical given the island’s legacy winter ‘snowbird’ market from Northern Europe and Russia. Putting the Alternative Local State Quarantine program at the head of the reopening tourism initiative, 17 Phuket hotels have been approved and 21 applications are under process. Properties who have undertaken both the expense and time in qualifying for the status have been shut-out, given the government’s about-face policy of centralizing all overseas arrivals into Bangkok.

What is unclear is the logic in policy flip flop on negating the island’s essential tourism lifeline. Using smaller contained resort-focused islands would appear a logical risk mitigation strategy that was echoed in all of the hype over the ‘Phuket Model’ but after the dust has settled, it ultimately failed to launch.

The time has come that Thailand must gain confidence from international benchmarks, such as the tourism dependent Maldives. According to data from the nation’s Ministry of Tourism, in October the destination recorded 21,514 tourist arrivals. This trend is again on the rise in November and looking back the country has safely managed the reopening of its borders since mid-July. Another nearby island, namely Singapore is set to put an overseas travel bubble into place within this month to Hong Kong (SAR).

Putting Phuket’s economy debacle into perspective C9’s Bill Barnett says “losing this high-season will further intensify the catastrophic impact on the island’s business owners and the livelihoods of the vast majority of residents. Given the sheer size of the hotel inventory, it cannot survive only on domestic visitors, cheaper airfares, or by adding more public holidays. For Phuket, this high season, faced with the prevailing arithmetic the island can only wait and wonder what comes next.”

Global Hotel Chains Refocus to Management-Light Approach to Weather COVID Storm

- Press Releases

- |

Soft Brands, Franchising and Third-Party Hospitality Operators Rising in Across Southeast Asia

For Immediate Release, 5th November, 2020

BANGKOK Dramatic changes are happening to new hotel development projects across Southeast Asia due to the severe COVID-19 triggered slowdown with global and regional chains rapidly shifting their attention to conversion opportunities and a management-light approach.

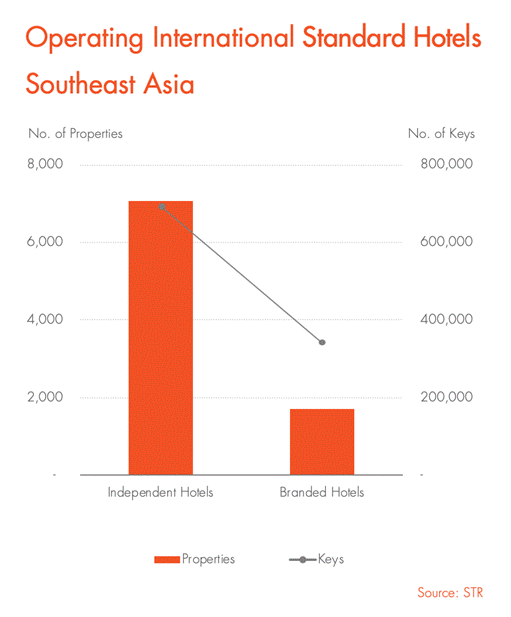

From a market size assessment, the stakes are high, according to data from STR, with over 80% of their reporting 8,757 international standard hotels in Southeast Asia classified as independent. The recent Soft Brand Hotels Review research by hospitality consulting group C9 Hotelworks further notes that the top three countries in the region with the highest number of independent hotels are Vietnam, Indonesia and the Philippines.

Southeast Asia’s explosive hospitality growth trajectory over the past decade has been driven by developers new to the industry or those expecting hyper-tourism growth. This love affair with hotels has quickly soured in the wake of the pandemic and suddenly owners are looking for stopgap measures for their multimillion-dollar assets as operating losses mount by the day.

“It’s ugly out there and about to get uglier,” says C9 Hotelworks Managing Director Bill Barnett. “Rising pressure from lenders, and a mounting storm of unpredictability has set hotel owners adrift in a sea of economic uncertainty.

“This is especially prevalent in the midscale and upscale tiers, as most markets are domestic reliant, and seeing cheap deals at the top end of the market creates a domino effect across tiers. Bottom line, there simply is not enough broad demand to sustain Southeast Asia’s hotel sector and the squeeze is felt directly where the largest room supply sits, in the middle.”

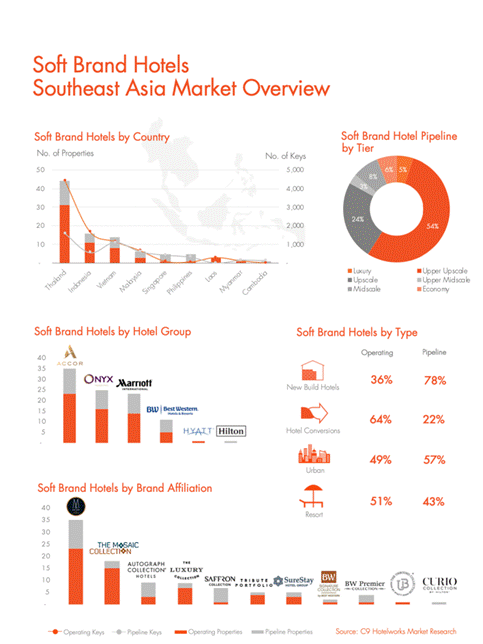

Another key hotel trend across the region highlighted in C9 Hotelworks’ research is the emergence of greater emphasis on soft brand offerings by global brands such as ACCOR, Marriott, and Hilton. This light approach takes in to account a growing number of owners who want their name reflected on properties and non-standardized design approaches. Add on the fast-track to conversions for operating properties or options to franchise for experienced developers and there is clear evidence of major shifts in the industry.

Speaking to this C9’s Bill Barnett adds, “Southeast Asia’s hotel industry is being driven into a new cycle by the necessity generated by the pandemic, and common practices in North America and Europe that are now accelerating into the region. Our research shows fast development in franchising, third party operators, and a pivot by international chains to management-light approaches. Given the significant size of independent hotels, it’s a logical step to fish where the fish are.”

Summing up the post-COVID outlook, David Johnson CEO of Delivering Asia Communications says “distribution and brand are on the cusp of a new disruptive cycle. While it’s a total departure from the standardized mass-market approach in recent times it is without a doubt the shape of things to come.”

To download C9 Hotelworks report Soft Brand Hotels – Southeast Asia Market Review:

You might also want to view C9 Hotelworks recent virtual online event on Soft Brands and White Label Hotels with leading hotel groups and experts speaking.

Phuket Hotels Fight For Their Lives As Massive Economic Fallout Expected From Failure Of Domestic Tourism To Support The Industry

- Press Releases

- |

New research by consulting group C9 Hotelworks points to Covid-19’s crippling implications with airport arrivals plunging, the Phuket Model stuttering and 50,000 jobs expected to be lost if there are no overseas visitors this year

For Immediate Release, 8 September, 2020

PHUKET, THAILAND Phuket’s hotel industry is reaching breaking point and drastic economic support from the government is needed for it to survive the high season, urge industry leaders.

In the wake of the controversial “Phuket Model” international travel reopening scheme, reality is biting back as hotels in Thailand’s leading resort island are unable to sustain operating viability based on domestic tourism.

According to the Airports of Thailand (AOT), passenger arrivals at the aviation gateway have plunged 65% year-on-year from January through July of this year.

What is clear is that the 86,000 rooms in Phuket’s registered accommodation establishments cannot realistically break-even or even be cash-flow positive with only domestic demand. This realistically could set the scene for 50,000 job losses in the hotel sector this year if there’s no support forth coming or international visitors are not allowed in.

One of the green shoots is the Alternative Local State Quarantine (ALSQ) program, with over 60 island properties applying. While this program is meant to emulate the ASQ program in Bangkok, given there are no direct flights to Phuket, the government needs wider support of a return of international travelers at a local level and implement inter-ministerial coordination before it could materialize. But this may take months.

Anthony Lark, President of the Phuket Hotels Association that represents 78 hotels in Phuket said: “The math simply doesn’t work with single-digit occupancies being reported. No amount of induced local demand can prevent the dramatic continued loss of jobs and rapidly eroding financial crisis for owners and operators. We strongly advocate a safe, pragmatic, and strategic reopening for foreign travelers.”

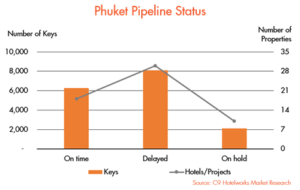

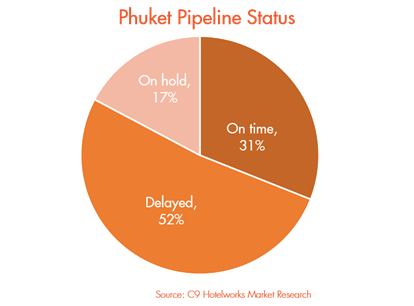

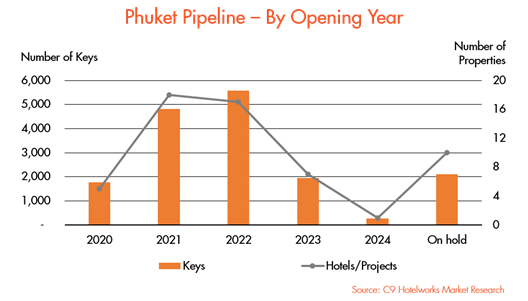

With tourism being the lead economic indicator in Phuket data newly released by hospitality consulting group C9 Hotelworks reveals the Covid-19 impact on the hotel development pipeline with 69% of hotels now being delayed or put on hold. Looking at the economic consequences, at the end of 2019, there were 1,758 licensed accommodation establishments on the island and today incoming projects stand at 58 hotels, representing a 19% rise in supply with 16,476 additional rooms planned.

C9 Hotelworks Managing Director Bill Barnett said: “Thailand’s failure to relaunch overseas tourism creates a dangerously perilous scenario for Phuket’s hospitality industry. The domino financial impact is not only on hotels and the expanded tourism sector, but it suffocates the development pipeline. This will negatively trigger the erosion of jobs in construction, real estate, retail and ultimately be manifested in consumer credit defaults. The situation is bad, and likely to get worse, as operating hotels remain incur losses day in and day out.”

In terms of updating the Phuket hotel situation on the ground, there continues to be much controversy and a lack of national and local consensus over the proposed “Safe and Sealed’ sandbox long-stay program. While a stark warning was issued last week by the Bank of Thailand (BoT) over the potential disruption to the heavily tourism-dependent country, the fate of Phuket’s coming high season remains very challenged.

Citing a way forward C9’s Bill Barnett commented: “Any reopening plan must not only be well planned but has to win the hearts and minds of the Thai people to see any chance of success. While the island may hold the keys to the Kingdom in leading a restoration of tourism, but the more critical issue is how hotels can fight for their lives in the current state of limbo.”

Speaking about Phuket’s current situation Anthony Lark added: “Firstly, greater proactive dialogue between the public and private sector has to be undertaken. We can’t simply say we are now in unknown territory forever. Steps must be taken and a single voice formed.

“Secondly, the Bank of Thailand (BoT) has to look at interim measures to assist hotels with short-term operating bridge loans to weather the storm and retain jobs. Tourism is a human endeavor and without protecting and nurturing our Thai workforce there will be no recovery.”

For further information or high-resolution photography, please contact:

Anthony Lark

President

Phuket Hotels Association

E-mail: [email protected]

Sunisa Pollasit

Delivering Asia Communications

Mobile: 087 690 1620

E-mail: [email protected]

www.delivering.asia

Phuket Hotels Association members are as follows:

Amanpuri, Anantara Layan Phuket Resort, Anantara Maikhao Phuket Villas, Anantara Vacation Club, Andara Resort & Villas, Angsana Laguna Phuket Resort, Banyan Tree Phuket, Boathouse by Montara, Burasari Resort, Cape Sienna, Centara Grand Beach Resort, Club Med Phuket, Dream Hotel & Spa, Dewa Phuket, Grand Mercure Phuket Patong, Hilton Phuket Arcadia, Holiday Inn Maikhao, Holiday Inn Resort Phuket, Patong, Hyatt Regency Phuket Resort, Impiana Resort Patong, JW Marriott Phuket, Le Meridien Phuket Beach Resort, Maikhao Dream Villa Resort & Spa, Manathai Surin, Movenpick Resort Bangtao Beach, Novotel Phuket Kamala Beach, Novotel Phuket Karon Beach, Novotel Phuket Phokeethra, Novotel Phuket Surin Beach Resort, Outrigger Laguna Phuket Beach Resort, Outrigger Laguna Phuket Resort & Villas, Paresa Resort, Phuket Marriott Resort and Spa, COMO by Point Yamu, Pullman Phuket Arcadia Naithon, Pullman Panwa Beach Resort, Renaissance Phuket Resort & Spa, Rosewood Phuket, Swissotel Resort Phuket Kamala, Swissotel Resort Phuket Patong Beach, Thanyapura, The Bell Pool Villa, The Nai Harn, The Pavilions, Phuket, The Slate, The Surin, The Village Coconut Island, The Westin Sirey Bay Resort & Spa Phuket, Trisara, Twinpalms Phuket.

Thailand’s tourism recovery hinged on tapping into 227 million strong domestic marketplace

- Press Releases

- |

Over 1,000 travel industry participants at Thailand Tourism Forum 2020 – Special Bangkok Edition – virtual online conference

TTF 2020 Bangkok-based speakers (from left): QUO CEO, David Keen; Rosewood Bangkok Director of Sales and Marketing, Leanne Reddie; Centara Hotels & Resorts CEO Thirayuth Chirathivat; IC Partners CEO, Charles Blocker; Hotel Intel Editor-in-Chief Wimintra Raj; Delivering Asia Communications CEO, David Johnson; and Horwath HTL Director-Thailand, Nikhom Jensiriratanakorn.

BANGKOK Thailand’s domestic-led tourism recovery was at the forefront of a virtual online event “TTF2020 – Special Bangkok Edition” today that tapped more than a 1,000 leading domestic and international travel and hotel industry participants.

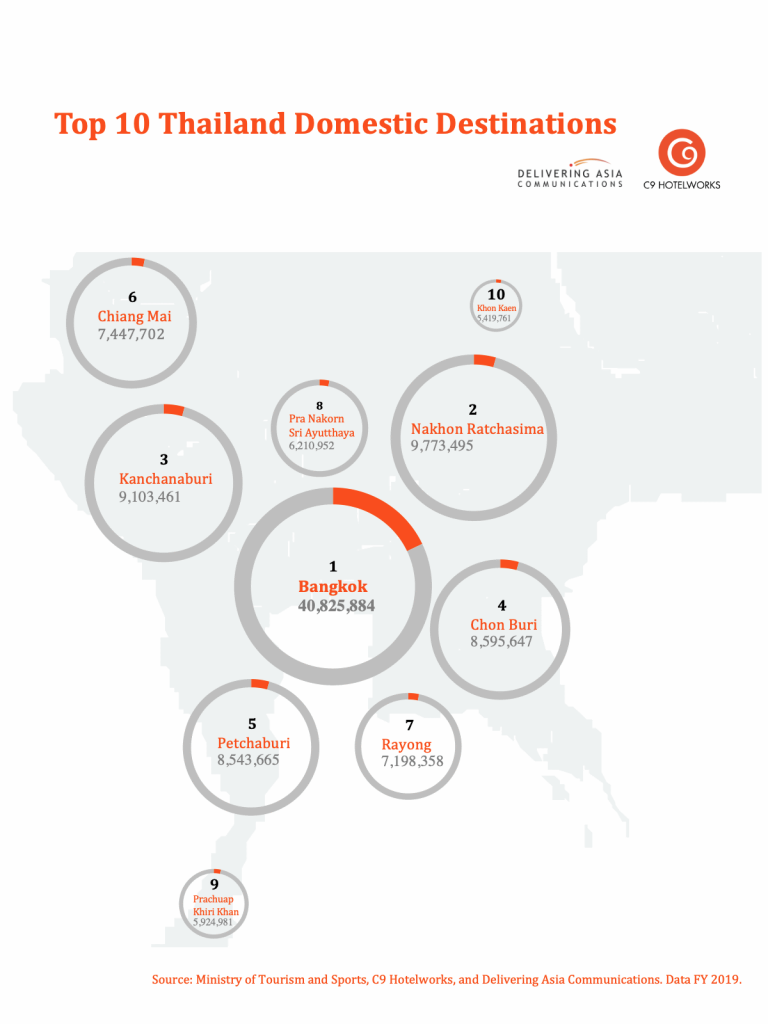

Research from hospitality consulting group C9 Hotelworks and Delivering Asia Communications focused on domestic inter-Thailand visitor market whose size at more than 227 million in 2019 stole the limelight versus 39.8 million international visitors. This set the event stage for a compelling look into the pent-up demand of local travelers who are now being targeted by Thai hotels and tourism establishments.

In a series of random polls as part of C9 and Delivering Asia’s market insight held over the weekend in Bangkok, an assortment of Greater Bangkok residents that represent more than 15 million people in the expanded metropolitan area voiced a clear preference for less dense, more natural provincial destinations. Those most mentioned were the islands of Koh Chang and Koh Kood and mountain areas of Phetchabun, Nan, Pai and Mae Sot.

To view the special event video edition of Greater Bangkok residents talking about Thai domestic travel click.

TTF 2020 Bangkok Edition: keynote speaker Centara Hotels & Resorts CEO Thirayuth Chirathivat (right) interviewed by Delivering Asia Communications CEO, David Johnson.

Thailand domestic travel data by C9 Hotelworks and Delivering Asia Communications

In a key segment of the event by global hotel intelligence group STR, which zeroed in on the country’s gateway capital, Area Director – Asia Pacific Jesper Palmqvist said “as Thailand’s economic engine, Bangkok will need to lead by example coming out of the crisis and promote and enable the domestic business that exists. In hotel metrics, this will change the definition of what are ‘acceptable performance levels’ are.” As to what lays ahead for hotels Palmqvist added “forget about hitting 2019 levels again anytime soon and instead focus on recalibrating what acceptable hotel trading levels are. There is a case to be made for either economy and midscale or luxury properties to emerge more efficiently. Though the question remains, with tighter traveler belts on the horizon, which class of hotel will represent the fastest route to longer term recovery?” Summing up the takeaway points of TTF2020 – Special Bangkok Edition, C9’s Managing Director Bill Barnett said “while international tourism remains a work in progress that is highly leveraged on bilateral cross-border agreements and restoration of airlift, the near-term goal of hotels is to attract cash flow. Expect Thailand to take to the road in considerably greater numbers for the remainder of 2020 and the industry will have to fish where the fish as part of the recovery journey ahead.” An impressive line-up of speakers for the event, organized by C9 Hotelworks and the American Chamber of Commerce Thailand, included Centara Hotels and Resorts CEO Thirayuth Chirathivat and key senior executives from JLL, Horwath HTL, QUO, TSI, STR, Agoda, IHG, HotelIntel and Rosewood Bangkok. To download the full-length event video and presentations, visit this link. |

Young, Independent, Digitally-Driven Travelers to Lead Vietnam’s Travel Reopening: China Vietnam Travel Sentiment Survey

- Press Releases

- |

Vietnam’s global tourism ambition needs to focus on China and short-haul travel, concludes latest research.

BANGKOK: Vietnam’s remarkable reopening of its domestic travel sector is expected to be replicated by focusing on short-haul Asian markets in a quest to restore their international tourism profile. The country has effectively demonstrated a Covid-19 leadership model in Southeast Asia with a focus on the all-important driver of airlift demand.

A newly released survey of qualified travelers from first tier cities in China by leading hospitality consulting group C9 Hotelworks and Delivering Asia Communications, created to understand relevant overseas travel sentiment for the remainder of 2020, analyses demand for Chinese inbound tourism to Vietnam.

Key points highlighted in the study are that nearly half of the respondents want to travel abroad this year, with 45% interested in traveling specifically to Vietnam. Moreover, post Covid-19 Chinese travelers are looking at more mainstream, well-known destinations with top Vietnam picks being Ho Chi Minh City, Hanoi, Nha Trang/Cam Ranh Bay and Halong Bay.

Speaking about the reopening of Vietnam tourism, C9 Hotelworks Managing Director Bill Barnett said “a post crisis short-term ‘fear factor’ is expected for extended air travel which will be manifested in a preference for short-haul, door-to-door flights, which is a key opportunity for China outbound to Vietnam.

“Of equal importance is to understand that at the moment, and in the coming months, domestic travel and tourism will define the gradual recovery process. What is significant about the China Vietnam Survey is who are the immediate post crisis travelers and how can hotels and tourism stakeholders proactively meet their needs. We see a parallel trend in early travelers both domestically and from the China data, which pair up in a new tourism visitor profile,” said Barnett.

Putting the market insights to use is an important sentiment voiced by David Johnson, CEO of Delivering Asia Communications, who added “a 360 view of the results from over 1,000 qualified respondents concludes that tourism for the remainder of the year will be heavily leveraged by younger travelers in the age range of 20-29 years old, who increasingly place an emphasis on booking hotels on digital platforms.

“Two other significant trends from our China research showed that aside from sightseeing and eating being key activities, nature moved up in preference, which could be a reaction to a post-crisis change in tourism values. Diving into accommodation preferences, the two ends of the price spectrum of budget/economy and five-star hotels drew most positive responses from the Chinese surveyed,” he said.

One final takeaway from the survey is how younger travelers are reflected in rising sentiment with 81% saying they would choose independent travel vs. group tours. This fact, coupled by younger Chinese booking travel digitally via WeChat and Fliggy is a new twist in Vietnam’s marketing to China inbound tourists.

In addition to the survey, a special free web event is being held on Thursday 7th May at 2:00pm Vietnam time led by C9 Hotelworks and Delivering Asia Communications including leading experts Ken Atkinson, Founder and Senior Advisor of Grant Thornton Vietnam and Vice Chairman of the Vietnam Tourism Advisory Board, Michael Piro, Chief Operating Officer of Indochina Capital and David Keen, Chief Executive Officer, QUO. Register here.

Read and download the China Vietnam Travel Sentiment Survey 2020 here.

Visitor singularity punctuates Phnom Penh’s journey to bright lights, big city

- Press Releases

- |

C9 Hotelworks reports that airlift exceeded record 2 million passenger arrivals last year

As fast-paced urban development and sprawling mega-infrastructure projects mount on Phnom Penh’s Mekong horizon, the obvious question is, where does it go from here? Cambodia’s shift from its singular tourism magnet Siem Reap, which is the access point of the iconic Ankor Wat, is now rapidly moving southward to the nation’s capital city.

Last year, the lead indicator of passenger arrivals by air saw Phnom Penh exceed 2 million passenger arrivals, surging past Siem Reap for the first time in a decade. Research by hospitality consulting group C9 Hotelworks has also captured data showing a steady sustained growth trajectory, as passenger arrivals recorded double-digit rate growth rates from 2012 through 2018, with a CAGR (compound annual growth rate) of 18%.

Clearly the key catalyst of change for the city has been its proximity to the country’s leading private and public sector headquarters and strategic location for China’s ambitious BRI (Belt and Road Initiative. The BRI now spans across Cambodia and runs all the way south to the Gulf of Thailand and beyond into the South China Sea.

Citing the critical business and tourism potential of the city is C9’s newly released Phnom Penh Hotel Market Update 2020 which reports that Asia is the dominate visitor source region, representing a 79% market share. More telling is a deeper data dive that 66% of the regional traffic is from Mainland China. Ranking the top 5 geographic source markets has China at the top with 52%, followed in order by Malaysia, USA, Japan and Thailand.

Moving on to how overseas travelers are funneling into the accommodation sector, C9’s report underscores that according to latest available data there are 313 hotels with 19,337 keys and 523 guests houses in Phnom Penh. A clear sign how fast-paced growth is impacting the hospitality sector is demonstrated in the fact that there are presently fifteen new hotels in the pipeline with 7,849 keys. It should be highlighted that thirteen of the upcoming properties are internationally branded by global hotel management groups including Marriott, Hyatt, Shangri-La and ACCOR.

As for the city’s hotel sector, there are challenges ahead with a spike of newer and bigger hotels and it yet to be seen how they will penetrate the existing hotel market. C9’s Managing Director Bill Barnett reflects “the next two years will see a massive transformation in the accommodation supply as ten new branded properties are forecasted to enter supply between now and 2022. While business travelers are the core guests, the task is how to attract other segments including tourists and the MICE sector.

Phnom Penh finds itself in a similar situation as other Asian CBD gateway capital hubs like Jakarta and Yangon where hotels are defined by weekday business travelers. Manila on the other hand has been able to capitalize in the gaming sector to grow the leisure segment and provides a more balanced model in the future.”

As for what are the prospects ahead Barnett adds “Cambodia’s new economic model remains unique in the region given the confluence of the BRI, though it’s sheer location is strategic by nature. With a young emerging working class, and influence of globalization, its economic history remains further in the future, so there remains a lot of work on the table in the foreseeable future.”

To read and download the full Phnom Penh Hotel Market Update 2020, click here

Region represents third of global stock

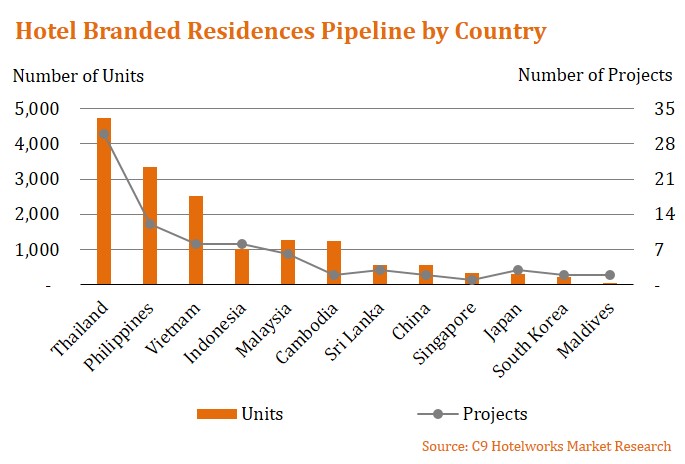

A sustained upward growth trajectory in Asia’s hotel branded residences is seeing the sector mature into a Grade A real estate asset class. According to consulting group C9 Hotelworks latest research, the Asian region now accounts of over a third of global stock.

One in three hotel branded residences globally are in Asia

Key metrics for investment grade branded residences properties in the region are reflected in a robust pipeline of 79 developments with 16,130 new units coming into supply by 2025. The most prolific real estate locations for upscale through luxury tier hotel branded properties are led by Thailand which represents 29% of incoming supply followed by Philippines and Vietnam.

Summarizing the research findings in the Asia Hotel Branded Residences Update C9’s Managing Director Bill Barnett reflected on the China-factor for branded residences saying “Mainland China has a substantial presence in luxury branded projects with over 57% of sold-out developments being located in first-tier cities.

Chinese developers expand to Southeast Asian countries

A second-generation trend has seen Chinese developers shift their attention outside of China while still tapping into Mainland investment or yield oriented buyers. These buyers are motivated by negative sentiment in a flat domestic market and look for greater opportunities overseas, with a selling proposition that is bolstered by the presence of international hospitality brands. Some of the notable publicly listed Chinese real estate firms who are aggressively pursuing international expansion include Vanke, Greenland Group and Country Garden.”

Another dynamic shift is Asian conglomerates developing hospitality-led residential projects abroad back of cross border investment strategies. A leading example of this is Malaysia’s Berjaya Corporation who developed the Four Seasons Hotel and Hotel Residences in Kyoto, Japan.

After project completion and highly-successful residential sales, the asset was sold at a premium valuation to a Japanese Group. Bolstered by the experience, Berjaya has moved onto a second project in Okinawa, with Four Seasons as an operator and a hotel branded residences component. For Berjaya, the addition of real estate has effectively mitigated development risk, improved hotel focused returns in a high-cost, low yielding hospitality market and ultimately added value on investment exit.

Real estate conglomerates attracted to exit strategies in sector

Some of the key learnings from C9’s research is centered on how branded residence demand is becoming more balanced between resort or leisure destinations and urban locations. While the former commands 58% of the marketplace, urban properties now account for 42% and are on the rise. Looking inside the numbers Asia’s urbanization trend and changes in lifestyle are mirrored in how affluent property buyers are moving from traditional single-family homes or compounds into luxury condominiums in CBD areas. Given how Asian’s value premium brands, developers are seizing the opportunity, boosted by brand-generated premiums and higher level of sales absorption.

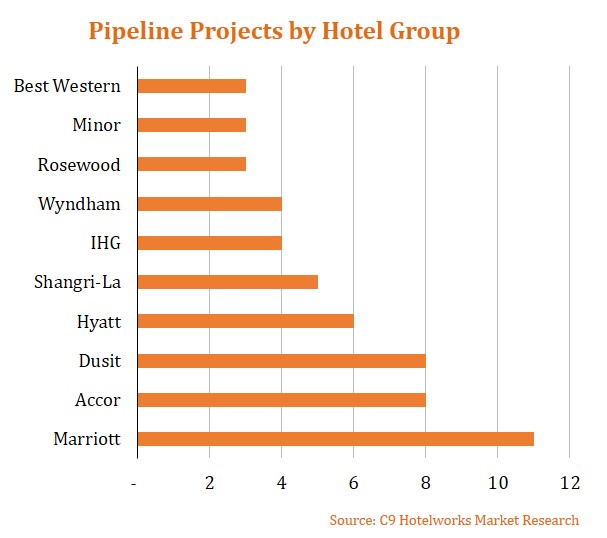

C9’s report has taken a critical look at the leading hotel groups in Asia’s branded residences arena. Ranking hotel operators in the upscale to luxury tiers who are prominent in the sector, Marriott tops the list followed by ACCOR, Dusit, Hyatt, Shangri-La, InterContinental Hotels Group and Wyndham. Other active operators included Rosewood and Minor.

58% of Asia’s total pipeline projects are in luxury tier

As to how the investment grade real estate sector could be impacted by the current COVID-19 crisis C9’s Bill Barnett is quick to acknowledge the disruptive nature onto the property market. Adding “we expect China’s early economic recovery to be similar to the experience at the tail end of the global financial crisis (GFC). An Asian sponsored uptick will align to the hotel branded residence product placement and be in tune with the times going forward.”

Read and download c9 Hotelworks Asia Hotel Branded Residences Update 2020.

For further information, please contact:

Bill Barnett, Managing Director, C9 Hotelworks

Email: [email protected]

Move Over New York and London: Bangkok Poised to Become the World’s Next Global Mega City

- Press Releases

- |

The East becomes the new West as mass transit infrastructure set to propel Bangkok to have the third largest Metro system in the world, experts reveal at TTF 2018.

BANGKOK, THAILAND – Industry experts revealed at Thailand Tourism Forum (TTF) 2018 that Bangkok is on the cusp of emerging as the world’s next Mega City. Within five years, the rapid expansion of Bangkok’s Metro systems will succeed in opening up unprecedented spaces in the city and with it huge opportunities for the travel and tourism industry.

This has not been lost on one of Thailand’s most prominent real estate developers, Sansiri PLC, who will bring one of the most dynamic New York hospitality brands to Bangkok – The Standard – in a major foray into hospitality as they seek to bring new cutting edge brands to the city.

Sansiri CEO Apichart Chutrakul gave the key note interview to open TTF 2018 on ‘MEGACITY BANGKOK – A Tourism and Hotel Futurescape’ to a packed ballroom of almost 700 travel industry delegates from Thailand and across the region at the InterContinental Bangkok.

In the opening remarks, TTF 2018 Co-Organiser and Managing Director of C9 Hotelworks said: “In five short years the electric metro across Greater Bangkok will reach a length of 464 kilometers. This will surpass London who stand at 402 km with their underground and New York City’s subway which measures 380 km. The great promise of the East has now become the new West. Important will be the access to three international interconnected airports – Suvarnabhumi, Don Mueang and U-Tapao.”

Global research firm STR’s area director Asia Pacific Jesper Palmqvist added that Bangkok was on a strong growth trajectory in terms of hotel performance and infrastructure development would only support this further. “With almost three years of stable growth in terms of hotel performance, Bangkok has firmly put the 2014 decline far behind. By November 2017, RevPAR had grown 3.4% year-over-year, and this against a backdrop of some reasonable strong supply increase at 4.1%.

“The impressive numbers are held up by an ever stable demand growth of around 5% for 18 months after the comeback in 2015, but hotels have also been able to increase rates by more than 2% even with new competing product coming to market. But it’s not just short-term – no less than seven of the months in 2017 saw 10-year records in absolute RevPAR performance – that’s a sign of very strong growth during the past 10 years for the mega city.”

In addition to Apichart Chutrakul, CEO of Sansiri PLC, speakers and panelists at TTF 2018 included Dillip Rajakarier, CEO of Minor Hotel Group; Supoj Chaiwatsirikul, Managing Director, ICONSIAM; Nikhom Jensiriratanakorn, Director of Horwath HTL; Thomas Schmelter, IHG’s Director of Operations for Thailand & Indochina; Mike Batchelor, JLL’s Managing Director, Investment Sales for Asia; Jesper Palmqvist, STR’s Area Director for Asia Pacific; Thomas Schmelter, Director of Operations – Thailand & IndoChina, IHG Group; and many more.

Phuket’s Low Season Growth and China Drive Amass Record Numbers in 2017

- Press Releases

- |

Developers eye tourism attractions to cash in on mounting visitor demand

Bolstered by a strong low season and double-digit China growth, Thailand’s leading resort destination Phuket has hit a historic high note. For the year 2017, the island’s gateway airport posted 11.3% y-o-y growth to reach an estimated 8.4 million incoming passengers. This was mainly driven by a 20% surge in Mainland Chinese travelers to the island and a rising number visitors during low season of 11.2% compared to the same period in 2016.

Airlift is clearly as the key catalyst according to consulting group C9 Hotelwork’s newly released Phuket Hotel Market Update. Hotel performance continued to see an uptick in occupancy at 77% last year based on data from STR, though the volume metric resulted in a slight downward trend with a median room rate of THB3,740.

Data in C9’s report reveals there was an average of 641,863 passenger arrivals per month in 2017 during low season compared to 759,703 in the high season. This is a significantly smaller gap than in previous years. What is demonstrated is how the island is evolving into a year-round destination. Another key trend is market-wide occupancy was pushed up as 54% of Chinese and 55% of Australians chose to visit Phuket during the May – October low and shoulder seasons.

Analyzing the market C9’s Managing Director Bill Barnett is quick to point out that island hoteliers need to be pragmatic about the impact in shifting geographic segments. “Phuket International Airport is the de facto entry point for tourists to Khao Lak which has nearly 9,000 hotel keys in its inventory. Lower priced accommodation and a large selection of beach front properties are benefitting from increasing Australian and Chinese numbers in July and August.

Two other key points are that while arrival growth is prevailing, the average length of stay is shrinking due to regional Asian market take up. And secondly exponential growth in shared economy offerings such as Airbnb are becoming mainstream competitors to hotels.

Soaring tourism numbers are only driving hotel development but peripheral sectors such as attractions. With its successful water park in Hua Hin, Proud Real Estate plans to start the development of Vana Nava Phuket by Q4 2018. Coupled with a 255-room Holiday Inn Express, the project is valued at nearly THB3 billion. Kata Water Park is another notable project that will begin construction in 2018. Developed by Kata Group on a 13-rai plot, replacing Kata Plaza, the plan includes a 300-room hotel and multiple dining outlets.

Summing up Phuket’s continued growth trajectory Bill Barnett of C9 Hotelworks says “while the recent upgrading of Phuket International Airport and new terminal has been a welcome change, the long-term reality is it’s just a band aid to a macro issue. As Khao Lak continues growing along with the beach areas North of Phuket, the need to diversify Phang Nga’s rising tourism market with its own airport is becoming more and more urgent by the day.”

Download: Phuket Hotel Market Update.