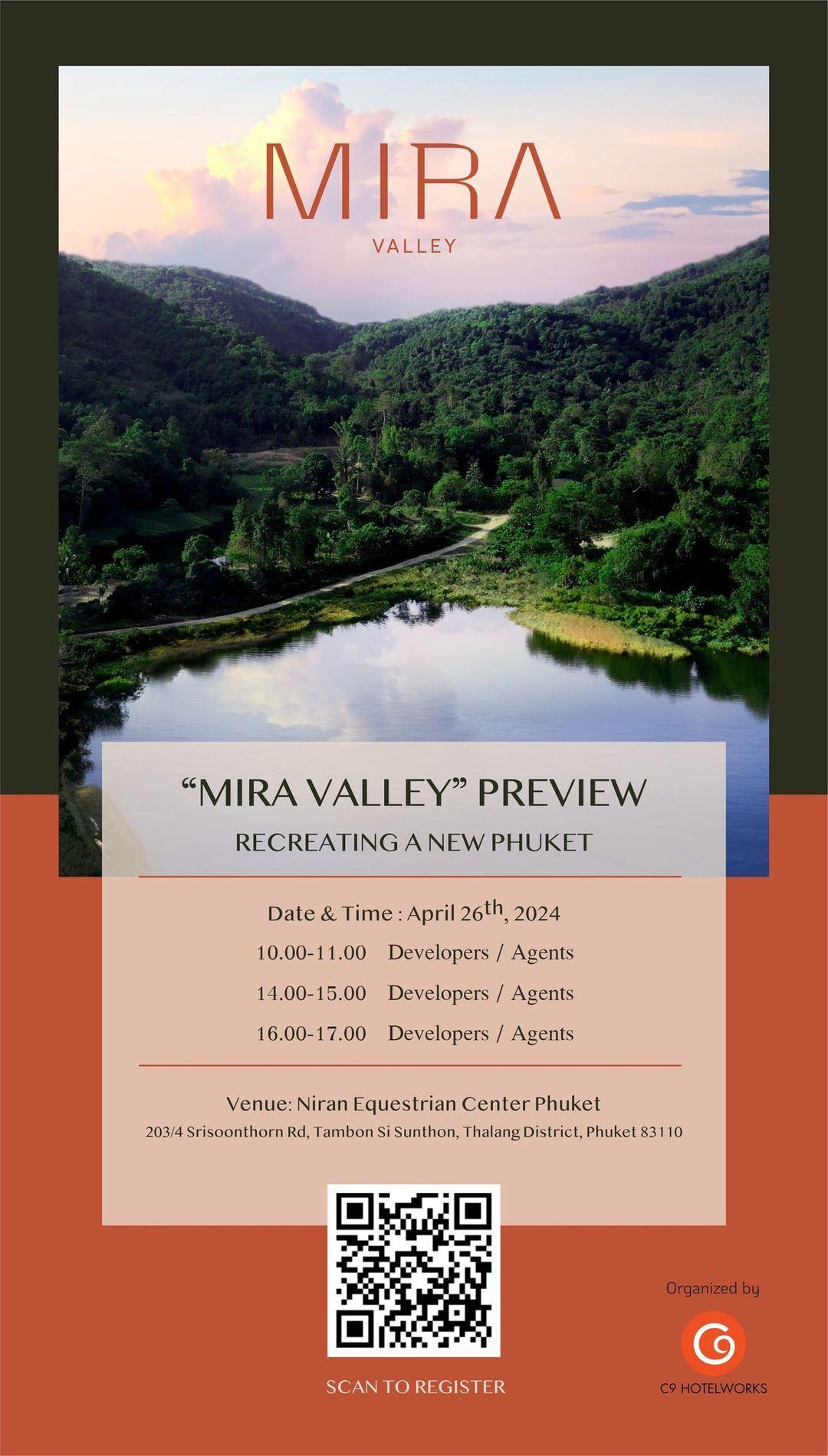

Catch this special event this coming Friday 26th April with a special preview of the new MIRA Valley master-planned community in the heart of Phuket, Manik. This is an amazing opportunity to acquire a development plot in a larger high-quality community.

This will be of special interest to property developers looking for land parcels, investors. and brokers. The plots are suitable for luxury home estates, townhouses, and condominiums, private schools, medical and wellness facilities, commercial and sports projects. There are development plots from 9 to 30 rai and above, which can also be combined.

We will be holding three one-house introduction sessions led by Bill Barnett of C9 Hotelworks who will give an update on the changing island Phuket infrastructure and key demand generators. An overview of the project, available development parcels, and details will be available as a chance to meet directly with the owners who are a highly experienced property group.

Space is limited so please confirm the session and timing if you will attend. The link to reserve is below:

Phuket’s tourism industry is undergoing an ongoing rebound, with last year’s airport passenger arrivals edging towards pre-pandemic figures according to C9 Hotelwork’s Phuket Hotel Market Update 2024. While hitting 7 million, it was still short of the 9 million mark set in 2019. This year the trend is continuing with 1.62 million arrivals to date in February, compared to 1.77 million recorded in the same period of 2019.

The Chinese market is slowly recuperating, with last year’s figures at 650,000, still a stark contrast to the 2 million arrivals pre-pandemic. Nonetheless, the introduction of visa exemptions for Chinese and increasing flight connectivity is anticipated to bolster these numbers.

Regional Southeast Asian markets are outperforming previous records, with Singapore’s arrival numbers doubling and Malaysia experiencing a 67% boost. These statistics underscore the potential of short-haul tourism in a world adjusting to post-pandemic travel norms.

Hotel metrics mirror this positive trajectory, with hotel occupancies soaring to nearly 78% in 2023. The Average Daily Rate (ADR) has reached a new historical peak, climbing 43% from the previous year. This uptick is attributed not only to returning tourists but also to Phuket’s ability to attract a higher-spending demographic.

The hotel sector’s development pipeline has slowed but is highlighted by 19 projects with 3,719 keys market, among which 3 properties are hotel conversion with 821 keys. Branded properties represent 91% of the pipeline. Based on C9’s market research incoming supply has been reduced by over 50%, as Phuket’s real estate market has seen land cost skyrocket, an overheated property sector, and a proliferation of branded residences. Many hotel owners and developers have shifted focus from greenfield projects to conversions and repositioning via renovations.

To download C9 Hotelworks Phuket Hotel Market Update 2024 CLICK

A new marina on the island’s East Coast in Ao Makham named ONE° 15 Marina Panwa Phuket will open in the fourth quarter of the year.

Developed by Singapore’s SUTL Enterprise along with Thailand’s Numchai Ocean Transport Company, the facility will accommodate yachts up to 120 feet in length.

SUTL, led by Singaporean Arthur Tay is best known for their iconic ONE° 15 Marina Sentosa Cove Singapore.

For more about Phuket’s marina facilities along with capacity and metrics read C9 Hotelworks The Phuket Report: Economy in Transition.

Thailand’s Prime Minster Srettha Thavisin’s trip to the resort island of Koh Samu focused on two infrastructure projects.

First, is the ongoing issue of expanding the island’s gateway airport, with a new feasibility study currently underway and to be completed by year-end for possible expansion.

Bangkok Airways who operate the airport is reportedly undertaking further land acquisition, though this is a longstanding legacy issue.

With a single runway just over two kilometers long, the airport is unable to land larger aircraft than an Airbus A319 which is a significant inhibitor of airlift.

Second, is a cruise ship terminal which is still in the process of site selection. The project is expected to go to the government’s Public Private Partnership Committee within the year.

In our opinion, the Prime Minister’s approach to funding these mega-infrastructure projects through PPP’s is a fundamental move in the right direction to address the country’s tourism infrastructure.

Learn all about the latest developments in C9 Hotelworks new Samui Hotel Market Update 2023. The resort island’s post-pandemic rebound is a work in progress as the destination continues to be defined by its airlift challenges.

While the limitation has largely muted large-scale development as seen in Phuket, the reality is that the infrastructure challenges go beyond airlift. As in much of Thailand, private sector investment has raced ahead of the public sector, and this is apparent in roadway and transport infrastructure.

There continues to be a debate about going big or staying small for the resort island, but in fact, Samui remains a strong performer in the luxury segment and has strong DNA.

To read and read C9 Hotelworks Samui Hotel Market Update 2023 CLICK

Calling all bright minds in the hospitality and tourism sectors. We’re excited to invite you to the “Thaiger Cage 2024” digital innovation pitch event as a prequel to the Thailand Tourism Forum 2024. Join us on Monday, 15th January 2024, at the InterContinental Bangkok at Thailand’s most popular annual ‘in person’ hospitality forum with an audience of over 1,000 industry people. The impressive judging panel includes start-up entrepreneur Michael Kenner who is Co-Founder and CEO of Thailand’s proptech leader FazWaz.

Organized by C9 Hotelworks Hospitality Consulting Group and supported by InterContinental Hotels & Resorts. Thaiger Cage 2024 is a collaborative effort with partners including Thaiger Media, Horwath HTL, STR, JLL Hotels and Hospitality, QUO, Delivering Asia Communications, AMCHAM Thailand, Creative Concept AV, Brand TD by Travel Daily Media, and the Phuket Hotels Association. This is where forward-thinking innovation converges with key industry players and potential investors.

Event Schedule:

Registration: From 2:00 PM onwards

Thaiger Cage Pitch Competition: 3:00 PM to 3:50 PM

Why Should Your Startup Join?

1. Showcase Your Vision: Present your startup’s unique solutions to an audience filled with industry heavyweights and decision-makers.

2. Network Extensively: Engage with a vast array of professionals, leaders, and innovators from diverse sectors.

3. Acquire Expert Insights: Benefit from the wisdom and feedback of industry experts who will critically evaluate each pitch.

4. Unlock New Opportunities: Discover paths to potential investments and forge valuable partnerships.

This is more than just an event; it’s a launchpad for your innovative digital platform and a chance to embed your startup into the heart of Thailand’s hospitality and tourism industries.

Apply Now and Elevate Your Startup: CLICK HERE

Application Deadline: Midnight 31st December 2023

Make sure to be part of this exhilarating journey of innovation, networking, and entrepreneurial growth. We can’t wait to see the unique ideas you bring to Thaiger Cage 2024.

Bangkok will once again play host to the upcoming Thailand Tourism Forum 2024. Topping the event whose theme is ‘Time for Growth’ will be Aditip Panupong from Google giving insight into how A1 already is, and how it will change the country’s tourism sector.

The two-hour program features 11 segments which will include how Thailand has become Asia’s leader in lifestyle hotels, why chef-driven dining and Michelin restaurants impacting traditional food and beverage offerings and how hotel owners can evaluate the potential to reposition and brand properties in the post-pandemic tourism marketplace.

Other key segments include why hotel operators need to reinvent their organizations, data and metrics-led insights into Thailand’s hotel performance and transaction market, emerging glamping and outdoor accommodation, and a deep dive into the challenges and opportunities of the China, Russian, and Indian inbound markets. Green and sustainability is a hotel topic as is tech innovation. A special one-hour prequel, The Thaiger Cage Hospitality Tech Pitch Competition will precede the main event.

Now in its 13th year, this annual event organized by hospitality consulting group C9 Hotelworks has continued to grow with fast-paced candid talks, a focus on industry data, and a dynamic evolving format covering the latest trends.

TTF 2024 is presented with its leading industry partners InterContinental Hotels and Resorts,

STR, Horwath HTL, JLL Hotels and Hospitality, QUO, AMCHAM Thailand, Creative Concept AV, Phuket Hotels Association, and host venue InterContinental Bangkok. Its media supporters are Thaiger Media and Travel Daily.

Registration for the event is free and space is limited. Sign up at CLICK

C9 Hotelworks has compiled a comprehensive investment report on the Phuket economy. Covering key island economic data including tourism, hotels, real estate, key demand generators, and infrastructure, the report features key metrics and takes a forward look at the potential shift in Phuket’s development.

Phuket has experienced a remarkably sustained tourism growth trajectory over the past 40 years. Since the emergence of Asia’s tiger economies in the 1980s, its strategic geographic location and the rise of Thailand as one of the world’s major tourism destinations have created a strong service sector.

The island’s tourism journey has seen a continued progression, starting with budget travelers and European snowbirds escaping the winter, and onwards to market maturity. Throughout this time, Phuket witnessed the birth of iconic tropical pool resorts and was the starting point for two global luxury brands: Aman Resorts and Banyan Tree.

Within close proximity to two of Asia’s leading financial markets, Hong Kong and Singapore, Phuket’s hotel, tourism, and real estate sectors have accumulated considerable direct foreign investment over the years. Its strong and successful track record has continued to attract Thai institutional capital and overseas private equity, family offices, and publicly listed investors.

Moving through the global pandemic, the Phuket Sandbox was the starting point for Thailand’s international reopening and Phuket was the first Southeast Asian resort market to welcome global visitors. COVID-19 also led to a boom in the island’s luxury real estate sector, as both domestic and foreign high-net-worth buyers opted for a new lifestyle choice.

Global economic events have seen soaring inbound migration to Phuket from a growing set of source markets. This growth has created one of Asia’s most dynamic and diverse international communities. With a fast-moving tourism and property market, we are now witnessing a rapid diversification of the economy into areas such as international education, health and wellness, retail, and marine industries.

This report is intended to provide insight into Phuket’s destination upcycling, its key economic indicators, and growth potential. Our conclusion is that the island is entering a noteworthy new era of development that will create a platform for one of the region’s most desirable international destinations.

To download and read The Phuket Report – Economy In Transition CLICK

Phuket’s once-quiet beachside west coast community of Bangtao is experiencing an unparalleled surge in real estate development. According to new research from C9 Hotelworks, there are currently 7,842 condominium units (click to see upcoming project map). Added to the supply influx are just over 2,400 upscale and luxury homes, which equate to a pipeline of more than 10,000 residential units in the market.

In what is a fragmented neighborhood of Bangtao, Laguna, Cherngtalay, and Layan, these areas traditionally formed what is a tourism-oriented district. All of this is now changing, and the influx of real estate projects looks to recast the area as Phuket’s ‘Gold Coast’ in what is an emerging metropolitan area.

Despite a methodical pace of property growth over the past two decades, the post-pandemic inward migration onslaught of expatriates has been nothing short of phenomenal. Inland land prices in the area have more than tripled over the past 24 months, where land that had been THB8-10 million a rai is now THB25-30 million.

One of the key triggers of the property boom has been the Russian-Ukraine conflict, which has supercharged what was already a growing geographic source of business for tourists and real estate. Russian buyers now account for the lion’s share of properties, though there continues to be diversity in broader terms. Coupling with the incoming Eastern European growth is a steady stream of lifestyle buyers who are jumping onto the urban flight trend to work from home and focus on quality of life away from highly populated cities.

There is a rapid rise in new residents from the US, Singapore, Hong Kong, China, and Europe. Key to the migration storyline has been the widely popular Thailand Elite long-term visa program as well as the government-initiated retirement visa. A secondary demand generator has been the strong growth of international schools, which are now in double digits in size and expanding. These offer access to dependent and/or guardian visas.

Moving back to the makeover of Bangtao from a tourist area into an international community, there is an escalation of residential properties in size versus hotels. C9’s research shows there are 2,837 rooms/key of international standard properties in the expansive area. These are now being dwarfed by property development, which creates challenges and a potential problem of unlicensed tourism accommodation.

Thailand’s Hotel Act, as it stands now, makes it difficult and in many cases impossible for residential condominiums or villa estates to obtain hotel licenses. For condominiums, the conversion from residential use to commercial use that is required for a hotel license has been stymied at local approval levels and remains a contentious issue.

What is apparent with over 10,000 new properties coming up is that not all buyers will be end-users or owners of holiday/second homes. In many cases, residential buyers have expectations of high rental yields from a flourishing Phuket tourism market, yet they might face problems in the future as projects lack hotel licenses. For the traditional hotel sector, there is concern over unfair competition from the informal rental market.

Realistically, the lack of a licensing mechanism for residential properties is putting the government at a substantial tax disadvantage, and funds that could be earmarked for badly needed infrastructure are an opportunity missed. Safety in non-licensed accommodation should also be a critical area of concern.

As to who is developing the upcoming projects, these are comprised of three main groups. Laguna Phuket remains the largest land bank in the Greater Bangtao area, and it has shifted focus from tourism to real estate as an economic necessity. With more projects within the main destination resort area, the company will also push into a new mixed-use community north of Laguna Village.

On the Thai development front, post-COVID19 has seen Bangkok developers active, such as CPN (Central Pattana), One Origin, AssetWise, and Sansiri. Local groups include Boat Pattana, Botanica, and Anchan. Given the escalation of land prices, the current state of play favors mid-rise condominiums as the only way developers can make an economic case with underlying land costs.

For the third group, Eastern European, or mainly Russian developers have flocked to the Bangtao area as market sentiment is at its highest level. These projects account for at least half of the total condominium units coming to market, due to the greater density of development. At the end of the day, rising land acquisition costs are spurring this trend.

Another change for Phuket property is the escalation of commissions which remain unstandardized. In many of the new Bangtao properties that lack brand or strong customer bases, commissions have risen to 7-10 percent. In certain cases, even a cash bonus of up to THB100,000 has been added to the incentive.

Whereas more traditional projects would have seen lower commissions and higher marketing costs, developers are now becoming massively reliant on a growing brokerage base. A growth spurt of Russian and Eastern European agents now sees projects chasing them for prospective buyers. Certainly, brokerage has taken center stage for the moment, though there remain questions as to the depth of their customer base longer term. One good example of underlying growth in brokerage is the leading portal FazWaz, which has established a strong base for online buyer generation.

Lastly, larger property groups are closely watching the formation of new Phuket development regulations. This is regulated by the Phuket Department of Public Works and Town and Country Planning together with the Bangkok-based Ministry of Natural Resources and Environment which oversees Environmental Regulations.

In C9’s discussions with experts on the draft plan which is expected to formalize in 2024, there will be a greater alignment to Bangkok-type rules that focus on FAR (floor area ratio) and higher minimum-road width for mid-rise development. It’s likely that given Phuket’s growth, certain areas will be zoned for high-rise development.

These changes, while needed, will come too late to address growing traffic concerns. The addition of over 10,000 new residential properties to the Bangtao area will see an uptick of large construction vehicles, a large-scale growth in private vehicles, and is a serious situation that has to become a government priority. Sadly, there is no blueprint structure for an expanding Bangtao metropolitan district that crosses many local jurisdictions. The most glaring immediate need is a traffic study and action plan by the municipality and highway department.

As a final point, one missing link in the growth of residential units is the lack of diversification of larger demand generators such as a full-service hospital, central parking structures, commercial buildings, international convention center, public parks, and pedestrian-friendly access. This, of course, is at odds with sky-high property prices that dictate highly dense projects to make economic sense. What is desperately needed is a Phuket Master Plan and acceleration of transportation infrastructure.

Bangtao’s journey into a metropolitan, ‘Gold Coast’ community is well underway, and we do expect cyclical growth to continue into the high season, but there is also a tendency to wonder: when does the market peak, and what comes next?

To view C9 Hotelworks Latest Phuket Hotel Market Update 2023 CLICK