Region represents third of global stock

A sustained upward growth trajectory in Asia’s hotel branded residences is seeing the sector mature into a Grade A real estate asset class. According to consulting group C9 Hotelworks latest research, the Asian region now accounts of over a third of global stock.

One in three hotel branded residences globally are in Asia

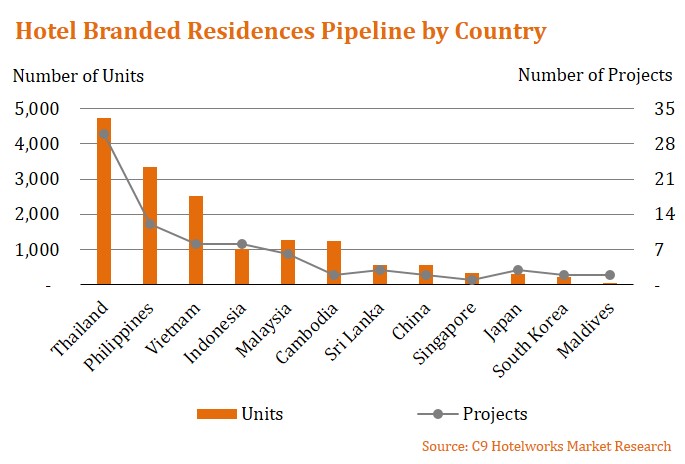

Key metrics for investment grade branded residences properties in the region are reflected in a robust pipeline of 79 developments with 16,130 new units coming into supply by 2025. The most prolific real estate locations for upscale through luxury tier hotel branded properties are led by Thailand which represents 29% of incoming supply followed by Philippines and Vietnam.

Summarizing the research findings in the Asia Hotel Branded Residences Update C9’s Managing Director Bill Barnett reflected on the China-factor for branded residences saying “Mainland China has a substantial presence in luxury branded projects with over 57% of sold-out developments being located in first-tier cities.

Chinese developers expand to Southeast Asian countries

A second-generation trend has seen Chinese developers shift their attention outside of China while still tapping into Mainland investment or yield oriented buyers. These buyers are motivated by negative sentiment in a flat domestic market and look for greater opportunities overseas, with a selling proposition that is bolstered by the presence of international hospitality brands. Some of the notable publicly listed Chinese real estate firms who are aggressively pursuing international expansion include Vanke, Greenland Group and Country Garden.”

Another dynamic shift is Asian conglomerates developing hospitality-led residential projects abroad back of cross border investment strategies. A leading example of this is Malaysia’s Berjaya Corporation who developed the Four Seasons Hotel and Hotel Residences in Kyoto, Japan.

After project completion and highly-successful residential sales, the asset was sold at a premium valuation to a Japanese Group. Bolstered by the experience, Berjaya has moved onto a second project in Okinawa, with Four Seasons as an operator and a hotel branded residences component. For Berjaya, the addition of real estate has effectively mitigated development risk, improved hotel focused returns in a high-cost, low yielding hospitality market and ultimately added value on investment exit.

Real estate conglomerates attracted to exit strategies in sector

Some of the key learnings from C9’s research is centered on how branded residence demand is becoming more balanced between resort or leisure destinations and urban locations. While the former commands 58% of the marketplace, urban properties now account for 42% and are on the rise. Looking inside the numbers Asia’s urbanization trend and changes in lifestyle are mirrored in how affluent property buyers are moving from traditional single-family homes or compounds into luxury condominiums in CBD areas. Given how Asian’s value premium brands, developers are seizing the opportunity, boosted by brand-generated premiums and higher level of sales absorption.

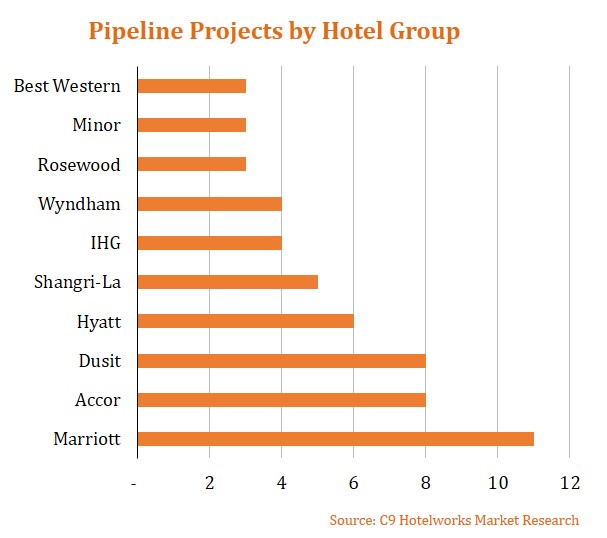

C9’s report has taken a critical look at the leading hotel groups in Asia’s branded residences arena. Ranking hotel operators in the upscale to luxury tiers who are prominent in the sector, Marriott tops the list followed by ACCOR, Dusit, Hyatt, Shangri-La, InterContinental Hotels Group and Wyndham. Other active operators included Rosewood and Minor.

58% of Asia’s total pipeline projects are in luxury tier

As to how the investment grade real estate sector could be impacted by the current COVID-19 crisis C9’s Bill Barnett is quick to acknowledge the disruptive nature onto the property market. Adding “we expect China’s early economic recovery to be similar to the experience at the tail end of the global financial crisis (GFC). An Asian sponsored uptick will align to the hotel branded residence product placement and be in tune with the times going forward.”

Read and download c9 Hotelworks Asia Hotel Branded Residences Update 2020.

For further information, please contact:

Bill Barnett, Managing Director, C9 Hotelworks

Email: [email protected]