Phuket’s Branded Residences Supply Tops USD2.3 Billion, Making Destination Largest Leisure Property Market in the World

- Press Releases

- |

New report from C9 Hotelworks reflects a blurring of the lines between global hotel brands and real estate as destination development hits new heights

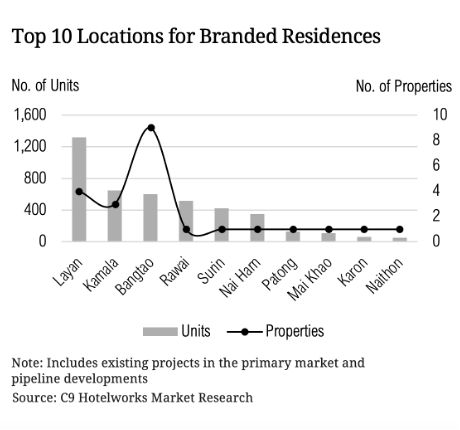

PHUKET, THAILAND: Phuket has seen an unprecedented onslaught of overseas buyers transform the island into the largest leisure branded residences real estate market in the world. The current supply of branded properties has now eclipsed a staggering USD2.3 billion (THB80 billion) and is expected to grow further according to new data from hospitality consulting group C9 Hotelworks.

One of the most compelling storylines of Phuket’s economic shift from a tourism-dependent economy into a property giant is the blurring of lines between hospitality and real estate. A key example is Phuket’s largest developer, Laguna Phuket, which has undergone a massive change in focus from hotels to branded real estate.

Earlier this year Singaporean tourism icon KP Ho’s Banyan Group announced that an adjacent land bank to their Laguna Phuket integrated resort would be developed into a USD2 billion lifestyle-led branded real estate offering. Ho’s longer-term strategy has changed from what was once a hotel-led strategy with the Banyan Tree brand at the forefront to a multi-brand strategy that has witnessed a renaming of the chain and creating a property-led growth trajectory.

Tracking the change of investment sentiment from hospitality to mixed-use projects, C9 Hotelworks’ Managing Director Bill Barnett says “post-pandemic we have seen a flood of Thai-listed real estate groups return to Phuket, spurred by an accentuated return to trading of the resort market and stabilization of tourism. Added motivation for developers though is soaring demand created by an influx of affluent overseas and domestic property buyers who are relocating to the island, or viewing investment in branded property as a safe haven.”

Some of the brands to enter the market recently include The Standard in Bangtao, an area that has been the epicenter of growth in the last year, including announcements by leading Bangkok developer Sansiri and Dubai-funded green-space real estate play Gardens of Eden spread over 73 rai (29 acres) of ocean-facing land.

Turning the page, Phuket’s tourism market in 2023 was all about higher room rates which for most hotel owners grew bottom lines. Market-wide hotel performance data from STR that compared last year to the high-water years of 2018 and 2019 reflecting higher average room rates by 20-30 per cent. Despite lower occupancy with muted Chinese demand by 2-10%, hotels experienced a net growth in profits.

In terms of hotel trading stability, Thai banks who went to the sidelines during the COVID-19 crisis re-emerged and are starting lending again to greenfield projects. With Phuket real estate showing strong transaction levels and rentals soaring, developers have quickly pivoted to mixing hospitality and property with the expectation of driving premium sale price through the use of brands.

Another factor has been necessity, where land prices across the island are skyrocketing. The only way to underwrite hotel projects is by adding a real estate component.

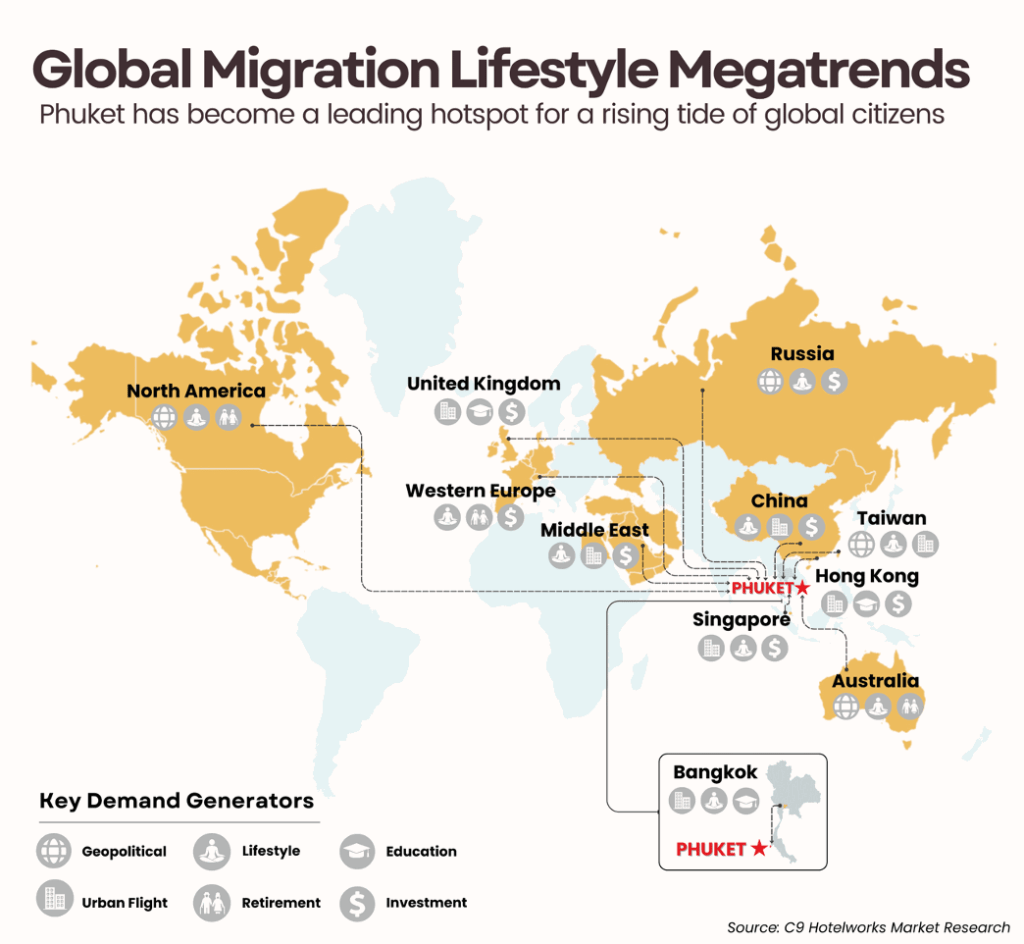

According to Barnett, it has become a game changing post-COVID19 mix of rising global migration spurred by geopolitical events coupled with urban flight. Added to this is the rising work-from anywhere culture and a graying global population who are retiring earlier or making lifestyle choices to move to leisure destinations. Thailand’s aggressive government policy on visa-free travel and progressive incentives such as long-term retirement visas and the long-term Thailand Elite program are further fueling the demand for property in Phuket.

Also highlighted in C9 Hotelworks’ research is a leading demand driver – a rising number of international schools that currently number thirteen and is expected to double over the next few years.

Speaking to the changes in Phuket from a once tourism-leveraged economy, Bill Barnett adds “this is not about the island changing, but how the larger world is undergoing unprecedented volatility coupled with the islands’ growing attraction as an international community.

The appetite for branded residences reflects a notable change in buyer values and we expect not only more hospitality affiliations but a significant new addition of non-hotel brands such as those from the fashion, automotive and restaurant sectors. Phuket, with its record setting resort-grade branded residences property supply, now stands side by side with urban best-in-class destinations Miami and Dubai as billion-dollar marketplaces.”

To download C9 Hotelworks Phuket Branded Residence Market Review CLICK.

For further information, please contact:

Bill Barnett

Managing Director, C9 Hotelworks

Email: [email protected]

Tel: +66 (0)8 1956 1802

www.c9hotelworks.com

As Phuket tourism market recovers, a potential “carmageddon” infrastructure crisis looms

- Press Releases

- |

New research shows that the island’s hotel market has

returned to pre-pandemic levels

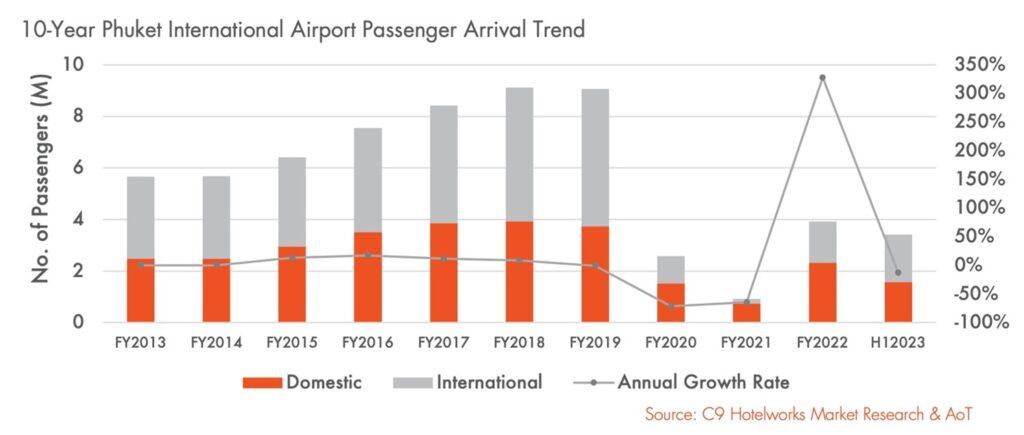

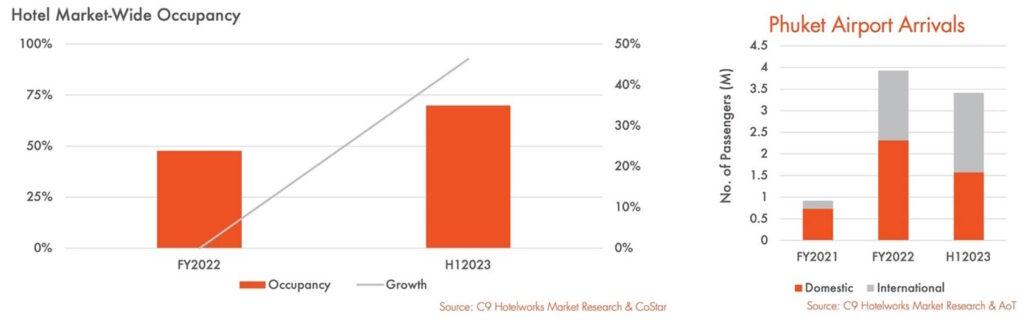

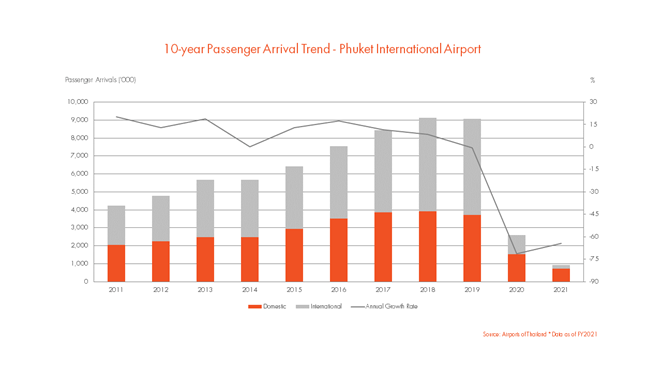

PHUKET, THAILAND: Phuket hotels experienced promising momentum for the first half of 2023, which has set an optimistic path for the remainder of the year. At the mid-year juncture, international and domestic flight volume was already up 75% over total flights in 2022.

Russia and China led the way as the two top tourism source markets in the first six months of the year according to research from C9 Hotelworks in their new Phuket Hotel Market Update report. Rounding out the top 5 overseas marketplaces were India, Australia and Kazakhstan.

Market-wide hotel occupancy in H1 surpassed the 70% threshold but the real boost for hotel owners has been a sustained post-pandemic trend in higher room rates. While business has returned to usual for much of the over 2,000 Phuket registered accommodation establishments encompassing 106,000 rooms, hotel owners and operators have been plagued by recurring staff shortages.

With Phuket’s hotel market roaring back this year and year-end forecasts likely to exceed pre-COVID19 levels, there is mounting concern over the resort island’s failing infrastructure. A surge in full and part-time residents – driven by a sharp uptick in tourism, an overheating property market and wholesale return of development activity – has created massive traffic issues that are a threat to long-term growth.

Speaking to the situation, C9 Hotelworks Managing Director Bill Barnett said “high season 2023/2024 is likely to see a “carmageddon”, traffic gridlock scenario that will have a profound impact on tourists and residents alike. The absolute failure to bring transportation infrastructure projects from paper to reality over the past decade will have long-term repercussions.

“Key projects that have not found their way forward include the Patong-Kathu tunnel, cross-island expressway and light-rail (LRT). While the current government has made all the right noise about making these projects a priority, there is no public sector funding capacity at present. This effectively means that a series of public-private partnerships or BOT (build-operate transfer) projects are needed to move these to execution stage. This includes the much-needed Andaman International Airport.”

Looking towards the coming winter peak period, C9’s market research has revealed that both hotels and tourism businesses remain deeply concerned over the slow return of Chinese travelers. Thailand’s image has been damaged in this enormous market, and travel sentiment to the Kingdom is muted despite a visa-free initiative. With China recovery a work in progress, most hotels are looking to strong demand from Russia, Kazakhstan and India, along with traditional ‘snow bird’ seasonal travelers.

Despite strong underlying fundamentals for Phuket hotels, C9’s Bill Barnett is quick to point out, “the first-aid, band-aid approach by the public sector to tourism simply won’t work in a mature international destination that Phuket has evolved into. For nearly two decades the island’s private sector has outgrown antiquated provincial infrastructure and what is desperately needed is a master plan and strategy that can fast-track an ailing infrastructure backbone.”

Click the link to read and download C9 Hotelworks Phuket Hotel Market Update

For further information, please contact:

Bill Barnett

Managing Director, C9 Hotelworks

Email: [email protected]

Tel: +66 (0)8 1956 1802

www.c9hotelworks.com

ROBUST PHUKET TOURISM NUMBERS IN Q4 LAST YEAR AND HIGH WINTER SEASON SET THE STAGE FOR RECOVERY BY YEAR-END

- Press Releases

- |

Return of Chinese travelers expected in the third and fourth quarter during key Mainland holiday periods

For Immediate Release, 23 March 2023

PHUKET Thailand’s leading resort island of Phuket’s post-pandemic tourism recovery has been headlined by a surge in Russian travelers in the high season. But the backstory is how a spike in regional visitors from India, Malaysia, and Singapore set the stage in Q4 of last year that pushed hotels and the service sector back into action.

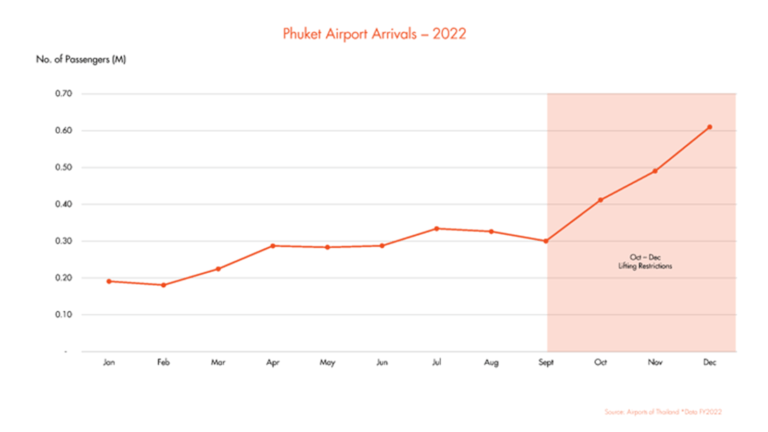

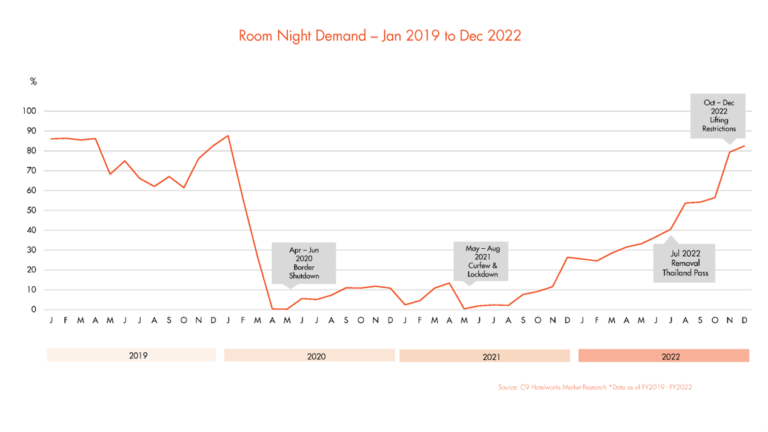

Data on hotel Phuket hotel performance in C9 Hotelworks’ newly released Phuket Hotel Market Update 2023 shows how the industry escalated after Thailand lifted travel restrictions at the beginning of October 2022. The influx of tourists propelled market-wide occupancy for the year to 48%, up year-on-year from a COVID-19-impacted low of 8% in 2021.

While Phuket’s winter high season which is November through to March has seen a return of the island’s traditional ‘snowbird’ visitors from Northern Europe and Scandinavia, the main mover has been Russia and a handful of other Eastern European countries. Despite limited direct airlift due to a backdrop of economic sanctions by the EU and airfares which have in many cases risen by 200-300%, the Russians indeed came. Though numbers were sharply down compared to the nearly one million count in 2019, stays increased from a normal average of 11 days, and rose by over 50%.

Speaking about the impact of the Eastern European markets on the island C9 Hotelworks Managing Director Bill Barnett said “the arrival of tourists from Russia not only created a spark in economic recovery for hotel and tourism businesses but radiated into retail, transportation, and real estate. The segment is now the most active direct foreign investment (FDI) leader in Phuket’s booming property market. A knock-on effect has been also seen on land prices across the island which are growing at their high rates in over two decades.”

Looking inside the numbers and key trends in Phuket’s hospitality industry, C9’s research points to a broader overall movement of hotel owners converting from management agreements to franchises and also changes in brands. Two recent notable deals has seen the Destination Group inking agreements with InterContinental Hotels Group (IHG) for two Holiday Inn properties and two with Radisson. Additionally, one of the island’s largest hotels, the Arcadia has been reflagged as a Pullman under ACCOR, and Thailand’s hospitality giant AWC (Asset World Corporation) have made public plans to upgrade and convert the Westin Siray Bay into a luxury resort branded to Ritz-Carlton.

Citing the conversions C9’ Bill Barnett commented “this is a sign of maturity for Thai hotel owners who are experienced enough to operate but look for distribution and brand value in a franchise scenario. This practice is prevalent in North America and Europe so it was only a matter of time until Asia caught up. We expect to see more changes in brands for the remainder of 2023 and beyond, given many hotel agreements signed in the early millennium tourism boom years are set to expire. “

Despite positive economic indicators, the reality on the ground is evident everywhere in the stress placed on Phuket’s transportation infrastructure. Population growth, development spread to inland areas and skyrocketing tourism demand has created a massive traffic problem. The clearest example was when a landslide closed an important thoroughfare between the popular Patong tourist area and its central island feeder road. Delays in repairs caused a domino effect in access to west coast hotels in peak season and demonstrated how fragile the island’s transportation network is.

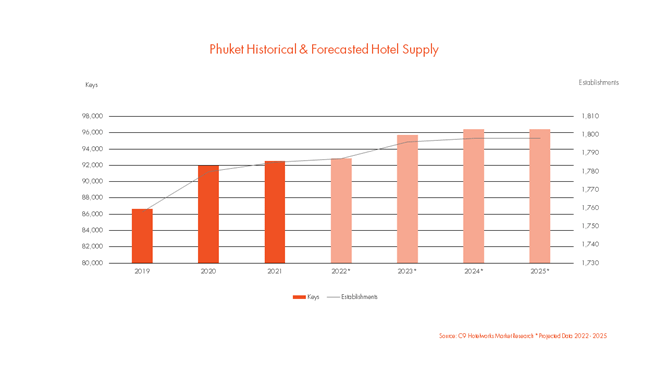

Reflecting on the potential return of mass tourism to Phuket, C9’s Bill Barnett who has lived and worked from Phuket for over 20 years said “the lack of a dedicated tourism master plan for the island is a key long-term issue that much is resolved. With airport flights and passenger flow mounting we can clearly see how important the new Phang Nga airport is, though the site remains inactive. This goes for the expressway and Patong tunnel projects that are in essence a lifeline for the island’s future growth. We punched the card of urbanization already and with nearly 100,000 registered hotel rooms on the island we’ve done too far to go back.”

To read and download C9 Hotelworks Phuket Hotel Market Update 2023 CLICK

For further information, please contact:

Bill Barnett

Managing Director, C9 Hotelworks

Email: [email protected]

Tel: +66 (0)8 1956 1802

www.c9hotelworks.com

THAILAND TOURISM FORUM PUSHES INNOVATION CENTRESTAGE AS INDUTRY LEADERS DEBATE THE FUTURE OF HOSPITALITY

- Press Releases

- |

THAILAND TOURISM FORUM PUSHES INNOVATION CENTRESTAGE AS INDUTRY LEADERS DEBATE THE FUTURE OF HOSPITALITY

Thailand’s largest annual tourism and hospitality event brings 800 delegates together for a fast-paced single-day show at Conrad Bangkok

For Immediate Release, 16 January 2023

BANGKOK, THAILAND: As Thailand’s tourism industry powers its way into an accelerated period of recovery, with international arrivals pouring in and China poised to create the next big wave, what’s the ensuing step for the Kingdom? The world has changed over the last three years so how is Thailand innovating to reshape the sector or is it back to the days of mass tourism?

Thailand Tourism Forum (TTF 2023) returned to Bangkok on Monday 16th January 2023 for its 12th annual edition to debate the issues and inspire future concepts. Running under the theme “Innovation in Hospitality”, the creative half-day event featured top-level speakers and discussions on key issues set to influence the industry in the months and years to come.

An 800-strong crowd of travel and hospitality professionals took part and heard how Thailand’s tourism machine needs to reinvent itself and become a pioneering force in branding, design and technology if it is to emerge stronger and more sustainable in the post-pandemic era.

Following an opening address by Bill Barnett, Managing Director of C9 Hotelworks, the event’s organiser, who explained “Why Thailand Must Innovate”, the forum’s keynote speaker took to the stage. Wallapa Traisorat, CEO & President of Asset World Corporation (AWC), Thailand’s leading hotel owner and developer, tackled the topic of “Creating a New Hospitality Landscape with Brands”.

Other important issues on the agenda included “Disruption and Change in Hotel Technology & Distribution” with Liz Perkins, Hilton’s Vice President of Revenue Management & Commercial Services for Asia Pacific, “Rethinking Thai Design Culture” with Ho Ren Yung, Banyan Tree’s Senior Vice President of Brand & Commercial, and the “Challenges of Being a Hotel Owner” with Proudputh Liptapanlop, Executive Director of Proud Real Estate. Delegates were provided with an update on Thai hotel transactions and financing by JLL Hotels & Hospitality Group and an analysis of the competitiveness of the Thai hotel industry by STR Global, before Greenview founder Eric Ricaurte revealed his vision for the “Hotel of the Future”.

The major challenge that demands attention, according to C9’s Bill Barnett is people, or the lack of them wanting to return the hospitality industry post Covid when over 1.45 million tourism jobs were lost. “Where’s our pipeline of people? This is what will create success for the next generation. Thais no longer want to work in hotels so our mission must be how can we innovate products and bring the best and brightest people back to the industry. We have to pay higher wages. Now is the time for Thailand’s hotels to change,” said Mr Barnett.

The point was reiterated by Proudputh Liptapanlop, Executive Director, Proud Real Estate PLC who said that Covid was a real wake-up call for owners about how to take care of their people.

Ms. Wallapa Traisorat, CEO & President of AWC, argued that product and brand integration was the key innovation for the future. “For us it is all about creating happiness,” she said. “We are all searching for how we can be fulfilled and I believe we need to look into partnerships with brands to create unique projects that are integrated with the destination and bring local communities into the hotel experience. It should be an integrated customer journey.”

For Liz Perkins, Vice President of Revenue Management & Commercial Services for Hilton APAC, the most important thing is to create the right balance between technology and people. “The key is to successfully merge physical and digital to create seamless travel. During Covid we invested in technology. For example, we introduced digital keys for a fast track check-in. Customers can still go to reception but what we are doing differently is giving customers choice.”

“For me innovation comes from constraints,” added Ho Ren Yung, Senior Vice President – Brand and Commercial, Banyan Tree Group. “We created the pool villa concept as we were not on the beach 30 years ago. Now we are introducing a product with no walls or doors to bring nature in.”

Pandemic economic impact hits Phuket hotels as 73% of new projects put on hold

- Press Releases

- |

Island’s transaction market heats up as owners face liquidity issues, while broad tourism sentiment wanes

PHUKET, THAILAND: Thailand’s battered hotel sector is showing increased signs of fatigue as the global pandemic enters its third year. Nowhere is this more apparent than the resort island of Phuket, where over 73% per cent of new hotel developments either lay dormant or have been put in hold.

According to data in the newly released Phuket Hotel Market Update 2022 from C9 Hotelworks hospitality consulting, the once robust island hotel pipeline has owners now suffering from ‘fear factor’ as they continue to reel in the wake of a volatile marketplace and unclear future outlook. Negative sentiment and stressed liquidity have impacted development, which has seen an incoming supply of 33 hotels with 8,616 rooms facing an unknown future.

Drilling down on the pipeline data, 55% of the hotel projects are mixed-use, or hotel residences with rental-based investment schemes that target individual investment buyers. In light of the economic climate C9 research indicates that some of these real estate-led hospitality projects are unlikely return to the pipeline.

While glossy tourism campaigns that focus on quality vs. quantity are the new mantra across the country, reality bites hard on an island that went from hosting over 9 million passenger arrivals at Phuket International Airport in 2019 to just over 900,000 in 2021. The sizable 90% decline, coupled with the fact there are already 1,786 registered tourism establishments and 92,604 hotel rooms in current supply mean empty beds that need tourists.

Speaking to the situation, C9 Hotelworks Managing Director Bill Barnett says “over 40% of the island’s international visitors two years ago were either from China or Eastern Europe including Russia. While I’m asked daily about when will Phuket recover, the truth of the matter is we are pushing out our estimates of a cyclical return to 2025.

“The elephant in the room for the moment is China. The conundrum is that while I fully expect Phuket stabilized numbers to return given its favorable geographic location, tourism-oriented infrastructure and demonstrated airlift capacity but macro political and economic issues are clouding the short-term horizon.”

Phuket led all of Southeast Asia in a remarkable effort of widespread vaccinations and the pioneering Sandbox re-entry program. But a look at the current situation which has seen a return to seasonal trading and departure of winter snowbird travelers dissipate, now has the island looking for replacement markets. As other regional neighbors such as Vietnam, Indonesia and the Philippines roll out quarantine free travel, Thailand remains in an uncompetitive situation given its beleaguered Test & Go process.

Hoteliers in Phuket have been quick to address damage control from the Ukraine Russia crisis, but most of the Russian market falls away in March historically. Three notable source markets that are ramping up airlift to Phuket are Australia, India and the Middle East, and these remain bright spots, though none have demonstrated traffic to match the mass Chinese market.

While Phuket’s tourism-leveraged economy has survived the first two years of the pandemic largely intact, C9’s Bill Barnett says “the remainder of 2022 and beyond is already seeing a rapid escalation of hotels coming up for sale. Most of these are not at highly distressed levels but what it indicates is that legacy investment sentiment in hospitality assets is experiencing a changing of the guard.

“The number of Thai hotel owners and also foreign investors that are retreating from the sector is expected to grow. C9’s opinion of the slowdown in the pipeline and high activity in the transaction market is this is not an entirely bad thing and will likely reframe supply and demand over the medium term in a return to a more solid, rational and less speculative marketplace.”

Another change in attitude for island hotel owners has been a wave of conversions of independent properties to brands given that many of the highest performing properties during the Phuket Sandbox reopening and growth in domestic travelers was to branded hotels. While another outcome has also seen a number of internationally managed properties converted from management to franchises. This reality of owners operating under global brands and a new influx of white label management has been a trend that was coming anyway and has only been accelerated by the pandemic.

Despite the bricks and mortar reality of Phuket’s tourism journey back to the future, the backstory of it has been a large-scale exodus of hospitality and service staff from the industry. Given the many stops and starts, opening and closings of hotels and businesses, the shine of tourism’s ‘Amazing Thailand’ byline has been lost on a generation of workers.

While business levels have continued to grow at moderate levels, staff shortages continue to plague the industry and perhaps the greatest challenge that lies ahead for Phuket hotels is regaining its greatest asset – hotel staff to serve tourists when they eventually return. That said, this same comment currently applies across all of Southeast Asia and the world, implying doing more with less staff will have to be the new tourism norm.

Download C9 Hotelworks Phuket Hotel Market Update 2022 – CLICK

THAILAND’S TOURISM INDUSTRY UNITES AT TTF 2022 AS HOSPITALITY LEADERS SIGN PLEDGE FOR THE FUTURE

- Press Releases

- |

Tourism leaders call for a full opening up of the country as concerns emerge that Thailand is losing the initiative to regional competitors and will not achieve 10 million arrivals in 2022

For Immediate Release, 1 March 2022

BANGKOK, THAILAND: More than 500 delegates, including many of Thai tourism and hospitality’s most senior figures, came together at the 11th Thailand Tourism Forum (TTF 2022) on 1st March 2022, with the aim of charting a strong and sustainable path out of the global pandemic.

TTF 2022, Thailand’s largest annual tourism and hospitality event, taking place as the industry grapples with an unprecedented period of crisis, opportunity, threat and disruption, ran under the theme #ThaiTourismUnited and kicked off with the Thailand Tourism Leadership Summit, which saw influential CEOs set out their joint vision for the future and jointly sign the Thailand Tourism Pledge.

Together, these leaders committed to forging a new strategic direction for Thailand, including placing tourism at the forefront of the national economy, putting the service sector back to work, achieving sustainable growth, and making international visitors feel safe and secure. The Thailand Tourism Pledge will lay the foundations upon which Thai tourism can be rebuilt from the ground up, following the devastation of the global pandemic.

Key to the discussion and among the excitement of the opportunity to create a better tourism future for Thailand, was a clear call by all leaders that it was time the country fully opened up. See opening remarks on the Thailand Tourism Pledge here:

Ms. Proudputh Liptapanlop, Executive Director of Proud Group, which owns numerous tourism assets including two InterContinental branded hotels in Hua Hin and Phuket, said: “In Thailand we need to open up. We need everyone to understand that we need to open up the country for their good and for the benefit of the country.”

Mr. Bill Heinecke, Chairman/Founder Minor International, added: “If we don’t open up we can’t be competitive. Currently the rules are just too complicated. We are not even 10% of where we were pre-Covid and Thailand will not reach its target of 10 million arrivals in 2022. We are falling behind. We are not even keeping up with our neighbours.”

“There’s no choice anymore,” commented Marisa Sukosol, President of Thailand Hotels Association. “Thailand must open up and stop Test & Go. In fact, it must Let It Go! We need to move our mentality from a pandemic to an endemic.”

TTF 2022 kicked off with a series of addresses, debates and discussions to help attendees devise strategies to survive and thrive in the post-pandemic era. Jesper Palmqvist, STR’s Area Director for Asia Pacific, presented the latest critical data, while Clarence Tan of Hilton and Charles Blocker, CEO of IC Partners, discussed “Why Hotel Operators Must Change”, Jakkrapong Chinkrathok, CEO & founder of Find Folk, focused on environmental issues with his “Green Thailand” session, and Wimintra Raj, Editor-in-Chief at Hotel Intel, went “Behind the Mask” to discuss new travel experiences. Other hot topics on the quickfire agenda included cryptocurrencies, hybrid spaces, hotel transactions and more.

Mr. Bill Barnett, Managing Director of C9 Hotelworks, concluded: “The reason we are here in-person is that this is where it starts. Travelling again starts today. We have to open the country and be competitive with Vietnam and the Maldives and put our service sector back to work.”

TTF 2022 was hosted in compliance with all necessary health and safety regulations. The host venue, Conrad Bangkok, is SHA+ certified and all attendees will be required show proof of two vaccinations.

For more information, please visit thailandtourismforum.com.

Domestic Property Buyers Swoop on Thai Resort Destinations as Second Home Market Soars

- Press Releases

- |

Changes in lifestyle and Covid-19 fatigue highlight a dramatic rise in urban flight

Thailand’s resort real estate markets have experienced a dramatic reset in buyer profiles over the past eighteen months of the pandemic. A strong wave of domestic demand has seen Thai’s flocking to the country’s leisure destinations and snapping up holiday or second homes.

According to new data released by Thai property portal FazWaz, the popular Thai seaside resort area of Hua Hin has seen buying interest grow significantly in year-to-date online inquiries. FazWaz Co-Founder and CEO Brennan Campbell said: “By tracking the data from Q2 2020 to mid-2021 on buying motivation of either a holiday home or for investment purposes, we can see a change in behavior towards lifestyle purchases in Phuket, Koh Samui and Pattaya, with the sharpest uptick being Hua Hin.”

In Phuket, where resort grade real estate over the past decade has been highly leveraged by foreign buyers, Boon Yongsakul, Chairman of Boat Pattana said “our Shambala luxury pool villa project in Bangtao Beach initially targeted legacy overseas buyers in the Laguna Phuket area. But by the middle of last year, we saw a strong influx of Bangkok buyers and this has continued to drive sales momentum to date”.

“One of the most notable characteristics in Thai buyers that has changed is the desire for resort living, quality of life, and outdoor areas. If you look back five years, island real estate was focused on investment-type condominiums, but today it’s single-family homes or second residences,” continued Mr Yongsakul.

Trying to get a fix on what is the new normal for Thailand’s resort property market, consulting group C9 Hotelworks Managing Director Bill Barnett weighed in with “Bangkok’s worsening pollution problems play a part in real estate purchase values. Another is the pandemic ‘Zoom-factor’ that has created what we expect to be a longer-lasting trend of working from home. Real estate developers are now facing changing consumer tastes for flex-specs and recreational areas.”

The trend for buyers seeking a lifestyle reset is clear in Hua Hin where property developer Tjeert Kwant, CEO of Banyan Residences, says there has been a significant rise in buyers looking to escape the city and enjoy a more healthy, active lifestyle. “This for us has been the key driver with families and couples and looking for spacious second homes outside of Bangkok.”

Adds Brennan Campbell of FazWaz “looking at our Insights data for Hua Hin, 64% of transactions are now from the domestic market. The impact of the pandemic is going to have a lasting impact on what drives Thai’s to purchase property and there is one thing for certain, the times are changing fast, and moving out of the city at a pace we have not seen before.”

WELCOME BACK HOME. An Interactive Online Tourism Event

- Press Releases

- |

Tourism eyes around the world are focused on the resort island of Phuket, Thailand. In the last two weeks the reopening of international, vaccinated travel to the Phuket Sandbox has created a model for other resort destinations to restart their tourism economies. A key emerging storyline from the island’s frenzied runaway to 1st July has been the remarkable cross sector partnerships that has become a true catalyst of change.

This timely one-hour online event is an opportunity to hear from industry experts who have been involved in the process and will be sharing their learnings. The event will also have an extensive question and answer session. The event will be particularly useful for those in the travel trade industry, media and tourism sectors given the Sandbox platform will likely emerge in other destinations.

Koh Samui’s Tourism Hopes Pinned on International Travelers

- Press Releases

- |

Sandboxes, islands, and beaches headline return of Thailand tourism

For Immediate Release, 10th July, 2021

It’s baby steps at the moment as Thailand’s Robinson Crusoe-inspired, island-focused international travel reopening plan is set to roll out in Koh Samui on 15th July. Unlike the Phuket Sandbox program for vaccinated travelers, the Samui Plus sealed-route will test the water with a hybrid approach of three days in a hotel quarantine scenario and then allows visitor’s island-wide free access from the fourth day onwards.

In anticipation of overseas travelers flying to the idyllic holiday island in the Gulf of Thailand over 60 hotels have been certified in the SHA Plus safety and health program according to hospitality consulting group C9 Hotelworks’ research. Gateway carrier Bangkok Airways has confirmed three domestic daily ‘sealed route’ flights from Bangkok’s Suvarnabhumi Airport starting in the middle of the month. International Samui Plus visitors will be required to fly via Bangkok and transit on these designated flights.

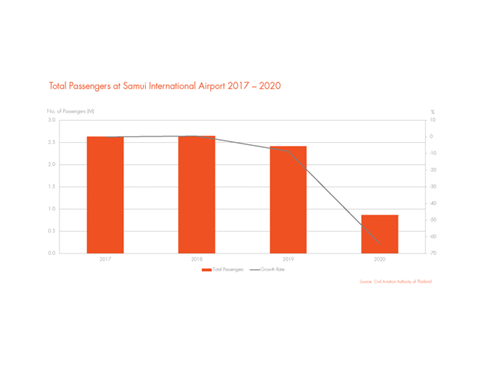

Koh Samui’s island economy is heavily dependent on tourism with over 600 registered tourism establishments and nearly 24,000 rooms. The impact of the pandemic can best be highlighted when looking at the airlift, comparing pre-pandemic 2019 and the onset and ongoing impact of Covid-19 which saw airline passenger traffic drop 64% year-on-year.

Speaking about the process of a gradual stepped programme for accepting overseas arrivals, C9 Hotelworks Managing Director Bill Barnett said “the learnings from the first week of the Phuket Sandbox will likely follow a similar pattern. Over 2,300 international arrivals have come to the island with more than 140,000 confirmed hotel nights booked in SHA Plus hotels through August. Demand has remained strong and is now demonstrated, which bodes well for Koh Samui’s chances.”

He added “an ancillary impact of the Sandbox is the restoration of regularly scheduled direct flights between the two islands from 16th July starting with four flights a week this month and becoming daily in August. In analyzing tourism, we look to the sky for answers as the logical starting point, and this increased airlift is a key driver for the tourism economy.”

Moving to the outlook for the island’s lodging industry, C9 Hotelworks’ new Koh Samui Hotel Market Update points out that the likely recovery journey will be top-down, with many travelers taking advantage of competitive rates in luxury and upscale tier hotels. C9 is forecasting the short to medium-term impact to be in rising demand at the expense of room rates as travelers tend to historically trade up in post-crisis travel.

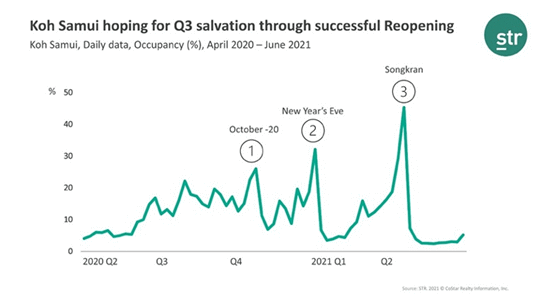

As Covid-19 has landed the tourism industry in unknown territory, leading global data group STR’s Area Director for Asia Pacific Jesper Palmqvist weighed in with “since Q2 in 2020 when the crisis started, we have seen three hotel peak periods in Koh Samui, where levels reached beyond the bare minimum – Mid-October 2020 for the long weekend, New Year’s Eve, and most recently the Songkran holiday where occupancies reached close to 50%. These spikes in demand came from the domestic market and once the international factor comes into play, more stability will evolve.”

While Thailand’s tourism fortunes remain highly focused on islands, C9’s Bill Barnett is quick to say “it’s important to remember that Koh Samui and Phuket remain only small pieces of a bigger puzzle and that even Robinson Crusoe had to eventually get onto a raft and return to the larger world at hand. Until the entire country gets better, the sandbox remains a relatively small stage.”

Download: C9 Hotelworks Samui Hotel Market Update.